In 2009 and 2010, the City/Authority issued the following Bonds to finance improvements to the City’s Water System that are now eligible to be refunded:

- $12,855,000 (original principal amount) 2009 Water Revenue Refunding Bonds, Series A (the “2009A Bonds”), of which $8,135,000 remain outstanding and will be refunded;

- $12,945,000 (original principal amount) 2009 Water Revenue Bonds, Series B (Federally Taxable - Build America Bonds - Direct Payment) (the “2009B Bonds” and together with the 2009A Bonds, the “2009 Bonds”), all of which remain outstanding and will be refunded;

- $2,410,000 (original principal amount) 2010 Water Revenue Bonds (Solar and Energy Efficient Projects), Series A, all of which have been paid off; and

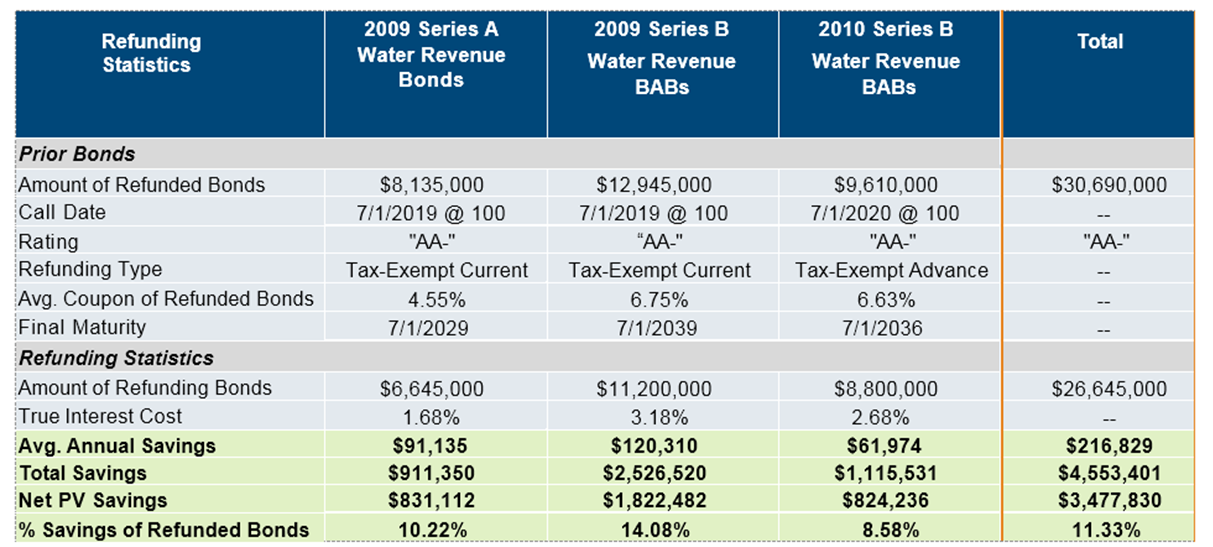

City Staff has determined in consultation with its Municipal Advisor, Fieldman, Rolapp & Associates, Inc, and its bond underwriter, Stifel, Nicolaus & Company, Incorporated, that current market conditions allow for the issuance of refunding bonds which will generate savings to the City's Water Enterprise Fund in the form of lower annual debt payments through refinancing the prior bonds. The City's Local Debt Policy requires a threshold of at least 3% net present value savings to be met in order to refund bonds. Based on current market conditions and subject to change, the projected 2019 Refunding Bonds have a projected net present value savings of 11.33%, and will produce an average annual reduction in bond payments of $216,829.

Therefore, on May 21, 2019, staff recommended and the City Council adopted Resolution 2019-033 approving the institution of proceedings to refinance the outstanding 2009 (Series A & B) and 2010 (Series B) Water Revenue Bonds of the Brea Public Finance Authority (the “2009 and 2010 Water Bonds”) by issuing refunding bonds. The City of Brea 2019 Water Revenue Refunding Bonds (the “2019 Water Refunding Bonds”) will be issued under the provisions of Articles 10 and 11 of Chapter 3 of Part 1 of Division 2 of Title 5 of the California Government Code, commencing with Section 53570 of said Code (the “Refunding Bond Law”). The 2019 Bonds will be secured by a pledge of and payable from “Net Revenues”, which consist of certain revenues of the Water System less operations and maintenance costs. It is noted the Brea Community Benefit Financing Authority also has 2014 Water Revenue Bonds (the "2014 Water Bonds") outstanding. The 2019 Water Refunding Bonds will be on parity with the outstanding 2014 Water Bonds.

Below is a table summarizing the detail for each series of Bonds to refunded and the anticipated savings:

Approval of the attached Resolution will approve the following documents in substantially the form presented which are required to issue the 2019 Bonds:

- Indenture of Trust – document between the City and BNY Mellon Trust setting up required accounts and providing the terms and provisions relating to the 2019 Bonds

- Escrow Agreement – document between the City and BNY Mellon Trust acting as an escrow agent to provide for the refunding of the outstanding 2009 and 2010 bonds

- Bond Purchase Agreement – document between the City and Stifel, Nicolaus & Company whereby the underwriter agrees to buy the 2019 Bonds from the City and resell them to bond investors

- Preliminary Official Statement – offering statement used to provide bond investors material information about the 2019 Bonds, to allow them to make an informed decision on buying the 2019 Bonds

- Continuing Disclosure Agreement – document requiring the City to provide annually updated information related to the 2019 Bonds until bonds are paid off

- Closing Documents – authorizing City officers and staff to execute and deliver all documents required for the closing of the bond issue.

|

| The outstanding 2009 and 2010 Water Bonds total $30,690,000. Staff is recommending that the City refinance the outstanding 2009 and 2010 Water Bonds bonds by issuing $26,645,000 in 2019 Water Refunding Bonds in order to reduce the average annual bond payments by $216,829. These are estimated savings based on current market conditions and subject to change. Additionally the 2009 and 2010 Water Bonds are being refunded within their existing term (final maturity). The anticipated savings from this refunding are expected to be used to stabilize water rates by offsetting future operational cost increases. |